It is said that BYD’s battery price increase will not charge, and it will be implemented on November 1st

Date: 2024-08-27 Click: 161

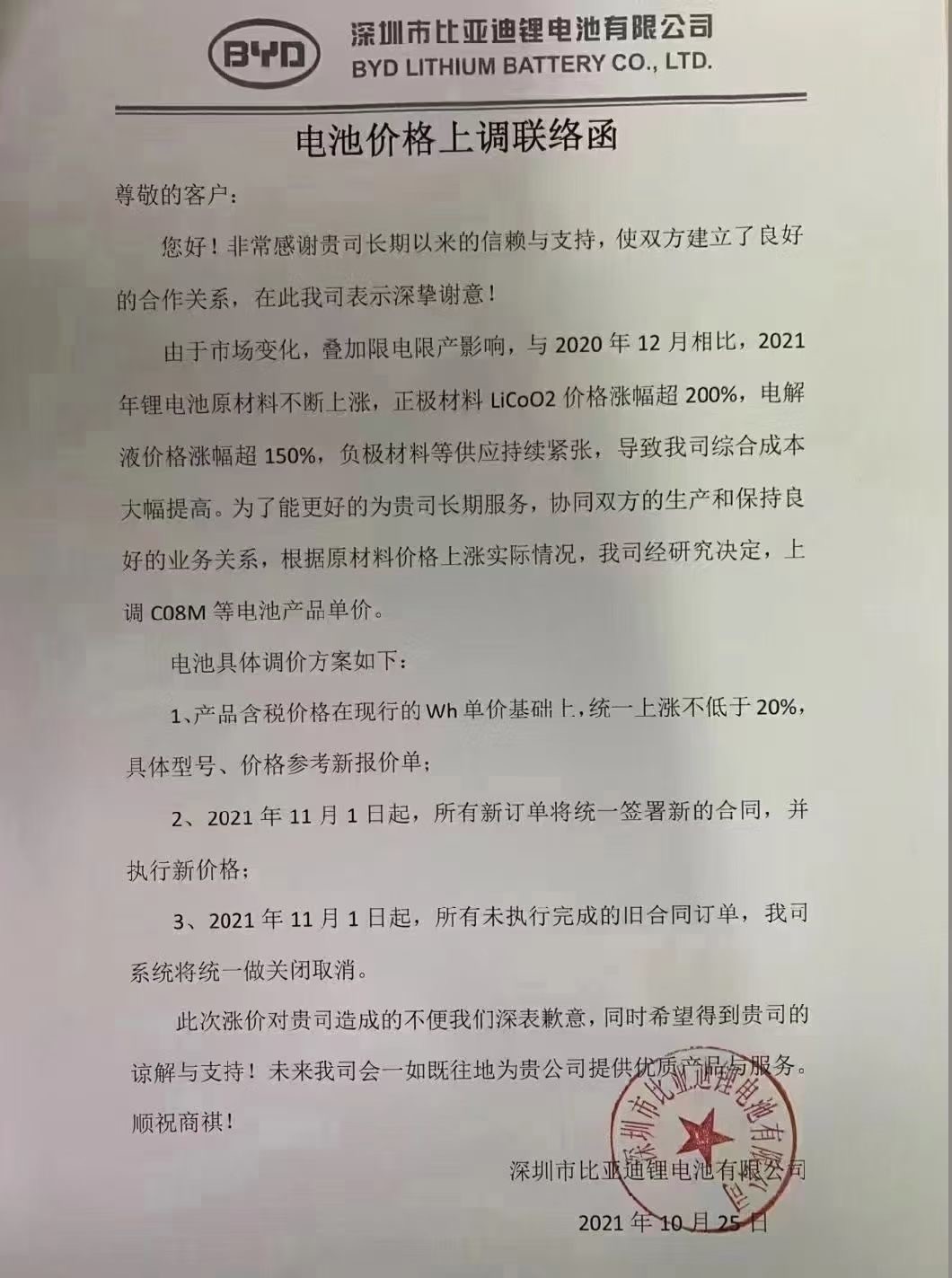

On October 26, a contact letter for BYD's battery price increase was posted on the market. According to the letter, due to market changes and superimposed power and production restrictions, compared with December 2020, lithium battery raw materials will continue to rise in 2021. The price of cathode material LiCoO2 will increase by more than 200%, the price of electrolyte will increase by more than 150%, and the price of anode materials As the supply continues to be tight, the overall cost has increased significantly. According to the actual situation of rising raw material prices, the unit price of CO8M and other battery products will be increased after research.

The specific battery price adjustment plan is as follows:

1. The tax-included price of the product will increase by no less than 20% on the basis of the current Wh unit price. Please refer to the new quotation for specific models and prices;

2. From November 1, 2021, all new orders will sign a new contract and implement the new price;

3. Starting from November 1, 2021, our system will close and cancel all unexecuted old contract orders.

In response to the above news, a BYD insider stated to the media: "verification is underway."

In fact, since the end of 2020, the skyrocketing price of raw materials has been transmitted to battery companies. According to calculations by relevant research institutions, the increase in raw material prices has caused the theoretical cost of power lithium batteries to increase by more than 30%, which makes power battery manufacturers that seem to be earning "full of money" to actually experience the risk of profitability being squeezed. In the first half of this year, different battery companies such as CATL, BYD, and Yiwei Lithium Energy all experienced a decline in their gross profit margins.

Earlier, Yang Hongxin, chairman and CEO of Honeycomb Energy, said that the price increase of key raw materials for power batteries is a market behavior, and there is no way to deal with it in the short term. What troubles battery companies is the problem of not being able to buy raw materials. "Currently, the power battery capacity gap should be 30%-50%, which is related to the product structure of different companies. This year, next year, and the next year, we even predict that the power battery capacity will be tight until 2025." , If raw material prices remain high, battery costs may further increase.